Published

Author: D. Sylla

Table of Contents #

Introduction #

Banco de Chile was founded on October 28th, 1893 in Santiago, Chile, as a result of the merger of Banco de Valparaíso and Banco Agrícola. It is a modern bank that provides commercial banking services, including retail banking, wholesale banking, and treasury and financial advisory services. In the U.S, the bank has branches in New York City and Miami.

Banco de Chile Stock Analysis #

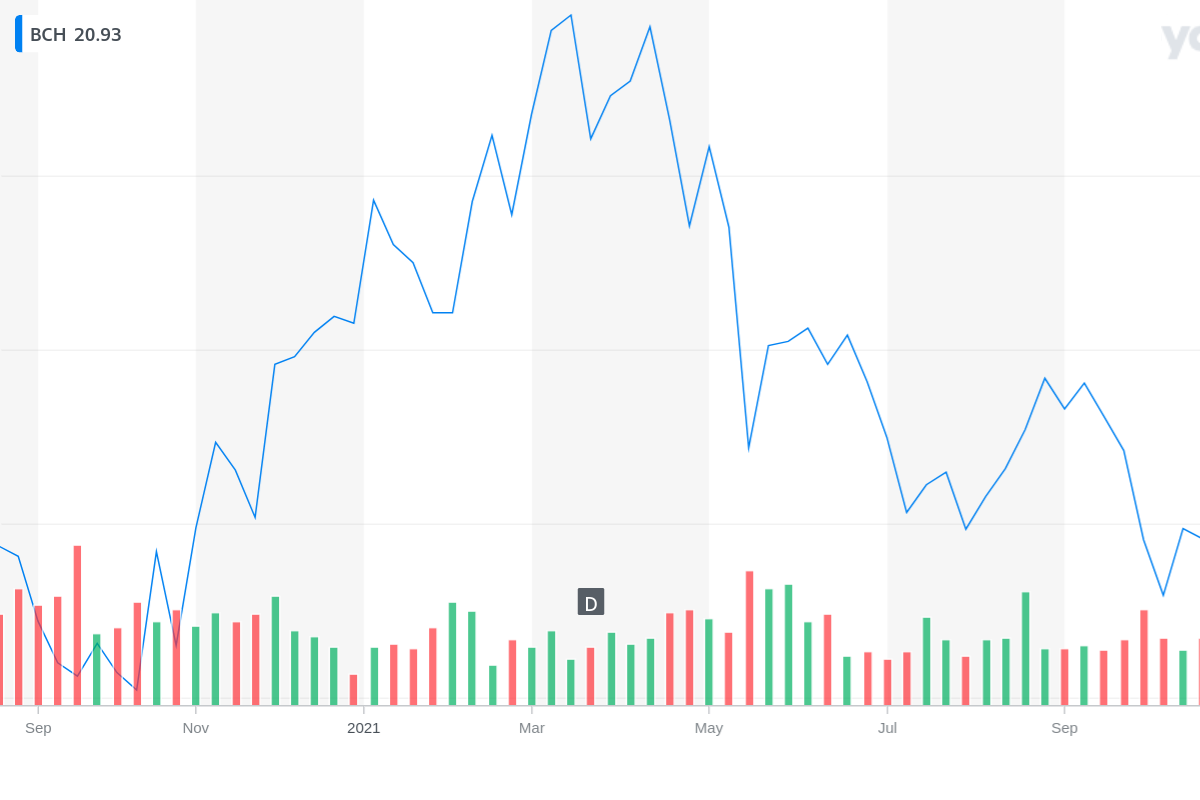

Banco de Chile’s common stock trades on the Santiago Stock Exchange in Chile, New York Stock Exchange (NYSE:BCH) in the U.S, and Frankfurt Stock Exchange in Germany. The bank’s ADRs* are also listed on the Stuttgart Stock Exchange and Berlin Stock Exchange. At the current stock price, on the New York Stock Exchange, the bank has a market capitalization of $10.47 billion.

|

|---|

| Source: Yahoo Finance |

The BCH stock generated a return of around 19% over the previous six months (between August 9th, 2021, and February 10th, 2022) as its price climbed from $17.60 per share to $20.90 per share. Since the start of 2022, the stock has gained around 28%, rising from $16.60 to its current price of $20.90.

| #EresDelChile #QueBuenoSerDelChile |

Analysis of 3Q21 Earnings Report #

Banco de Chile reported net income of **CLP18.4 billion for 3Q21, which is an increase of 14% from the same period last year. During the quarter, the bank maintained its leadership position in profitability and capital as its Tier 1 Capital Ratio and Return on Assets stood at 12.5% and 1.5% respectively, which is well above its peers in the banking industry. The bank’s operating revenues, including customer and non-customer income, also registered a healthy year-over-year growth of 9% in Q321.

The net fees income also grew by 22% to CLP 114 billion in 3Q21 from CLP 94 billion in 3Q20. The total loans figure also increased by 6% from the same quarter last year, rising from CLP 31.3 trillion to CLP 33.1 trillion. The wholesale banking, SME banking, and personal banking loans all contributed to the overall increase in total loans disbursement.

The bank’s coverage ratio in 3Q21 stood at 3.73, which is better than BCI’s 2.61 and Santander’s 2.59. Similarly, the bank’s delinquency ratio was 0.92% at the end of Q321, compared to Santander’s 1.22% and BCI’s** 1.36%.

Conclusion #

Banco de Chile performed exceptionally well in the third quarter of 2021 and continued its record of strong profitability and capitalization. The bank’s stock price has quickly appreciated in during the past six months, taking cue from its above-average financial results. The strong fundamentals coupled with continuous growth in its profitability makes Banco de Chile’s stock a decent investment option.

Additional Info #

For more information on Banco de Chile's FAN Account and other topics, visit:

You must be 18 years of age (18 años) to apply.

Banco de Chile on Social Media #

- Instagram - Banco de Chile (@bancodechile) • Instagram photos and videos

- YouTube - bancodechile - YouTube

- Twitter - Banco de Chile (@bancodechile) / Twitter

- Facebook - Banco de Chile - Home | Facebook

Acronyms:

- ** ADRs (American Depository Receipts): American depository receipts are depository receipts issued by US banks and evidencing ownership of shares in non-US companies.

- ** CLP (Chilean Peso): Currency of Chile

- ** BCI: (Banco de Credito e Inversiones): A Chilean Bank